Share this Post

Net Worth: The Clearest Reflection of Financial Health

Net Worth: The Clearest Reflection of Financial Health

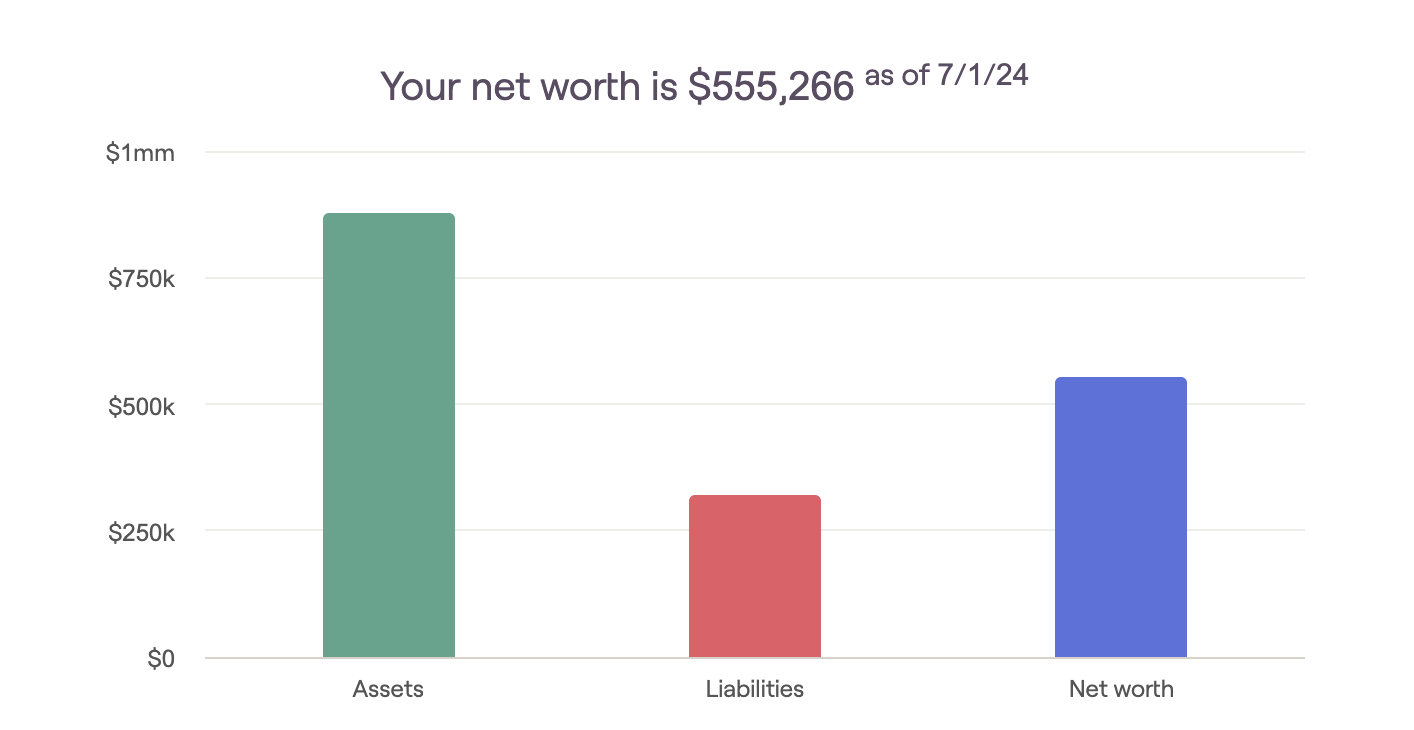

When assessing your financial health, understanding your net worth is crucial. It provides a snapshot of your financial standing and is a key indicator of your overall financial well-being. But what exactly is net worth, how is it calculated, and why is it so important?

What is Net Worth?

Net worth is the difference between your total assets and your total liabilities. In simple terms, it's what you own minus what you owe. This figure is a clear representation of your financial health at any given moment. Positive net worth means you have more assets than liabilities, while negative net worth indicates the opposite.

Calculating Your Net Worth

To calculate your net worth, follow these steps:

List Your Assets: Assets are anything of value that you own. This includes:

Cash and cash equivalents (savings accounts, checking accounts, money market accounts)

Investments (stocks, bonds, retirement accounts)

Real estate (primary residence, investment properties)

Personal property (vehicles, jewelry, collectibles)

Business interests (if applicable)

List Your Liabilities: Liabilities are any debts or financial obligations you owe. This includes:

Mortgage balance

Car loans

Student loans

Credit card debt

Personal loans

Other outstanding debts

Subtract Liabilities from Assets:

Net Worth=Total Assets−Total Liabilities

For example, if your total assets are $500,000 and your total liabilities are $200,000, your net worth is $300,000.

Why Net Worth is Important

Understanding your net worth is essential for several reasons:

Clear Financial Picture: Net worth provides a clear picture of where you stand financially. It helps you understand whether you are moving forward or backward in your financial journey.

Goal Setting: Knowing your net worth helps you set realistic financial goals. Whether it's saving for retirement, buying a home, or paying off debt, a clear understanding of your net worth can guide your financial planning and decision-making.

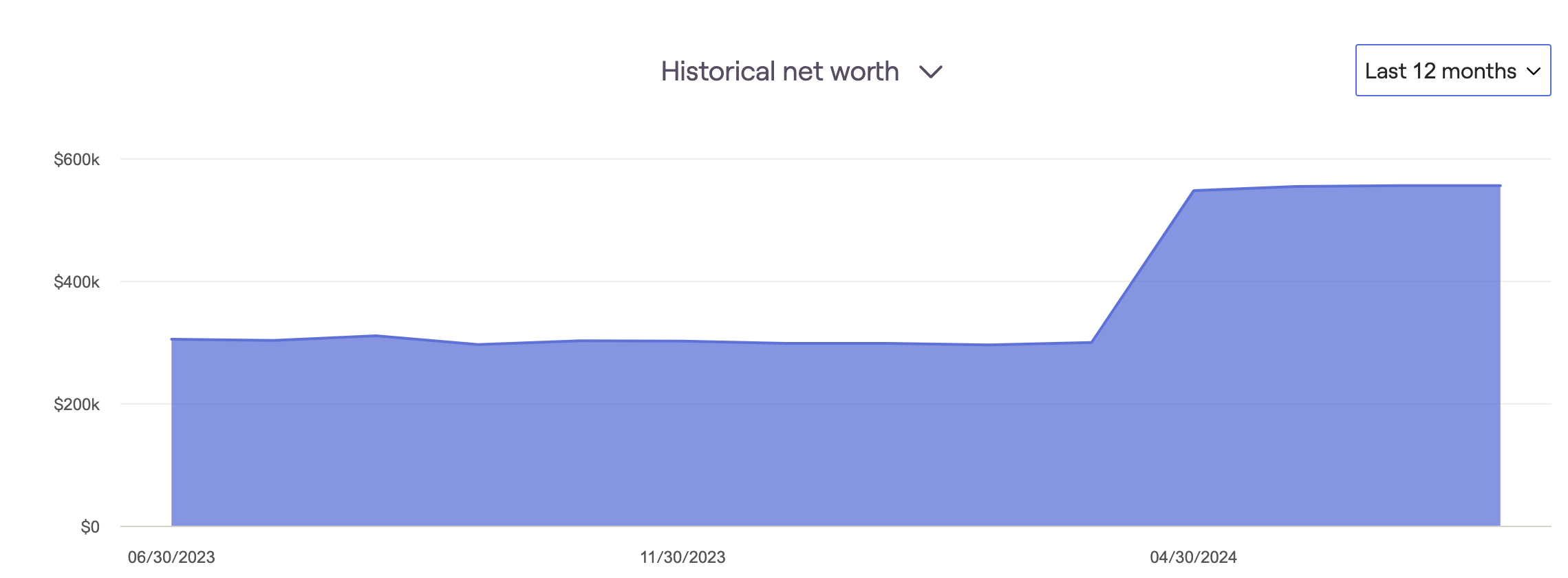

Track Progress: By regularly calculating your net worth, you can track your financial progress over time. This can be motivating and help you stay focused on your financial goals.

Debt Management: A negative net worth can be a wake-up call to manage your debt more effectively. Understanding your liabilities and working towards reducing them can significantly improve your financial health.

Investment Decisions: Net worth can influence your investment decisions. A higher net worth might allow for more aggressive investment strategies, while a lower net worth might necessitate more conservative approaches.

The Clearest Way to See Where You Stand Financially

Net worth is arguably the clearest way to see where you stand financially because it encompasses all aspects of your financial life. It doesn't just look at your income or your savings; it considers everything you own and owe. This holistic view is invaluable for making informed financial decisions and planning for the future.

Conclusion

Understanding and calculating your net worth is a fundamental aspect of personal finance. It provides a clear, comprehensive picture of your financial health and helps guide your financial decisions and goals. Regularly monitoring your net worth can ensure you stay on track to achieve your financial aspirations and build a secure financial future.

By taking the time to assess your net worth, you can gain valuable insights into your financial status and take proactive steps to improve it. Remember, the goal is not just to increase your net worth but to use this knowledge to make informed, strategic financial decisions that align with your long-term objectives.